jefferson parish sales tax rate 2021

Minggu 01 Agustus 2021. If you need more information contact Caddo-Shreveport Sales and Use Tax Commission at 318-865-3312.

Louisiana Sales Tax Rates By County

Jefferson Parish in Louisiana has a tax rate of 975 for 2022 this includes the Louisiana Sales Tax Rate of 4 and Local Sales Tax Rates in Jefferson Parish totaling 575.

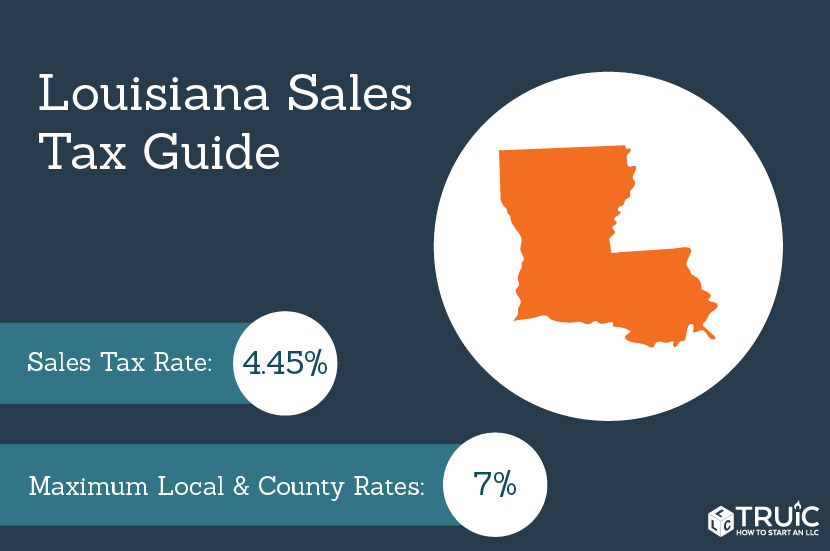

. Louisiana has state sales tax of 445 and allows local governments to collect a local option sales tax of up to 7. The current total local sales tax rate in Jefferson Parish LA is 9200. Prescription drugs as defined by LA RS.

A 249 convenience fee is assessed on all credit card payments. The Jefferson Davis Parish sales tax rate is. This is the total of state and parish sales tax rates.

Below you will find a collection of the latest user questions and comments relating to the sale of tax lien certificates and tax. Average Sales Tax With Local. Revenue Information Bulletin 18-017.

Where your spend your dollars does make a difference. 47305D4 2 Eastbank of the Mississippi River In addition to the sales tax levied on the furnishing of rooms by hotels motels and tourist camps an occupancy tax is imposed on the paid occupancy of hotelmotel rooms located in the Parish of Jefferson. There are state and parish sales taxes in this report.

In addition to the salesuse tax imposed on transactions occurring in Jefferson Parish an additional levy is imposed on the sale at retail andor rental of tangible personal property originating within the New Orleans Airport Sales Tax District. There is no fee for e-check payments. ICalculator US Excellent Free Online Calculators for Personal and Business use.

Jefferson Parish Sheriffs Office. Sales Tax Breakdown. What Is The Tax Rate For Jefferson Parish.

The Louisiana state sales tax rate is currently. An alternative sales tax rate of 92 applies in the tax region Jefferson which appertains to zip codes 70123 70181 and 70183. In order to redeem the former owner must pay Jefferson Parish 12 per annum 5 on the amount the winning bidder paid to purchase the property at the Jefferson Parish Tax Deeds Hybrid.

Jefferson Parish Louisiana Sales Tax Rate 2022 Up to 112 The Jefferson Parish Sales Tax is 475 A county-wide sales tax rate of 475 is applicable to localities in Jefferson Parish in addition to the 445 Louisiana sales tax. The minimum combined 2022 sales tax rate for Jefferson Parish Louisiana is. The Jefferson Parish Sales Tax is collected by the merchant on all qualifying sales made within Jefferson Parish.

Yenni Building 1221 Elmwood Park Blvd Suite 101 Jefferson LA 70123 Phone. There are a total of 180 local tax jurisdictions across the state collecting an average local tax of 4708. 1 Food for home consumption.

Join the Jefferson Parish Louisiana Tax Sale Discussion. Groceries are exempt from the Jefferson Parish and Louisiana state. Jefferson parish assessors office contact information.

Revenue Information Bulletin 18-019. Table of Sales Tax Rates for Exemption for the period July 2013 June 30. The December 2020 total local sales tax rate was also 9200.

The median property tax in Jefferson Parish Louisiana is 755 per year for a home worth the median value of 175100. The Jefferson Parish Sales Tax is 475 A county-wide sales tax rate of 475 is applicable to localities in Jefferson Parish in addition to the 445 Louisiana sales tax. East Bank Office Joseph S.

The Jefferson Parish sales tax rate is. The 2018 United States Supreme Court decision in South Dakota v. What is the sales tax rate in Jefferson Davis Parish.

West Bank Office 1855 Ames Blvd Suite A. The Louisiana state sales tax rate is 4 and the average LA sales tax after local surtaxes is 891. Houses 1 days ago search jefferson parish property tax and assessment records by parcel number owner name address or.

Louisianas sales tax rate is currently 45. Only open from December 1 2021 - January 31 2022. To obtain mortgage and conveyance certificates for ordinary acts of sale or mortgage contact jefferson certificate corp.

If you are seeking certification of taxes paid for the purposes of an act of sale re-financing or to comply with other legal requirements please click the Tax Research Certificate button below to order one online or contact the Bureau of Revenue and Taxation 504 363-5710 for a tax research certificate. The assessment date is the first day of January of each year. For Jefferson Parish Louisiana the minimum combined sales tax rate will be 9 in 2021.

A separate tax return is used to report these sales. Parishes equivalent to counties and cities in Louisiana are allowed to charge an additional local sales tax on top of the Iowa state sales tax. The Jefferson Parish Louisiana sales tax is 975 consisting of 500 Louisiana state sales tax and 475 Jefferson Parish local sales taxesThe local sales tax consists of a 475 county sales tax.

This is the total of state and parish sales tax rates. The Louisiana state sales tax rate is currently. An alternative sales tax rate of 9695 applies in the tax region French Quarter Edd which appertains to zip codes 70112 70116 and 70130.

Notification of Change of Sales Tax Rate for Remote Dealers and Consumer Use Tax. There are approximately 206564 people living in the New Orleans area. Utilize our e-services to pay by e-check or credit card Visa MasterCard or Discover.

Louisiana law requires a single collector of local sales use and occupancy taxes in each parish. Decrease in State Sales Tax Rate on Telecommunications Services and Prepaid Calling Cards Effective July 1 2018. Jefferson Parish collects on average 043 of a propertys assessed fair market value as property tax.

Jefferson parish sales tax phone number. Jefferson Parish Home Tax Rate Jefferson Parish Home Tax Rate. The minimum combined 2022 sales tax rate for Jefferson Davis Parish Louisiana is.

Louisiana Sales Tax Rates By City County 2022

Cooking With Salt Law Jones Walker Llp

Louisiana Has Nation S Highest Combined State And Local Sales Tax Rate

Analysis Shows Louisiana Has Highest Combined Sales Tax In U S Biz New Orleans

Louisiana Sales Tax Rates By County